Why did I receive a new credit card?

- New cards are issued upon expiration date. Your current card may be expiring soon.

- If you are a joint cardholder or an authorized user on the account, the primary cardholder may have requested that new cards be issued.

- You may have been issued a replacement card due to a potential breach.

What is a contactless-enabled chip card?

- It is a card that allows a cardholder to “tap to pay” or to complete a transaction by holding their card over a contactless-enabled merchant terminal.

How will I know if I can perform a contactless payment?

- Look for the Contactless Symbol at merchant terminals and simply tap your card to pay.

Where can I find more information about Visa contactless payments?

- You can visit Visa’s website for more information regarding contactless payments.

How can I dispute a suspicious transaction?

- Cardholders can call 800.259.0112.

- Signature cardholders can call 800.259.0114.

- Cardholders may also dispute transactions through the credit card SSO digital banking login, with the “Dispute” link by each transaction.

Will I be able to manage and/or access my credit card account (online or via app)?

- Yes, all businesses and their cardholders can have credentials created for a program called SpendTrack. SpendTrack is a business online account management application. There are two user authorities that can be utilized: Program Administrator (PA) and Cardholder.

- The administrator application enables PAs to view, update and manage business accounts.

- The cardholder application enables business cardholders to view their individual card account.

If my company does not have SpendTrack or a PA established, what do I need to do?

- A Business Credit Card Admin Form must be completed and sent back to First Bank & Trust. Once the Bank receives this form back, we will add up to three PAs to the company records. The PA will be able to establish additional PAs for the company and user access for all cardholders.

- To request a form, contact your account officer or call us directly at 800.843.1552.

What functionality is available in SpendTrack?

PAs have access to:

- Company Settings

- View all transactions (statements, payment history, manage payments, export transactions)

- Add or delete users

- Cardholder level tools

- Lock card

- Reset PIN

- Replace card, report lost/stolen, or close card – standard delivery only (7-10 business days)

- Rush card requests must be requested to the Bank and include a rush delivery fee of $30

- View transactions

- Update credit limit – permanent or temporary

- Update merchant types. Select the merchants to which the cardholder is allowed to make transactions. If a merchant type is not selected, transactions at those merchant types are denied.

- Analytics and audit logs

- Cardholder user access is given by the PA

- Cardholder level access is completely optional, and the features each cardholder has access to is provided by the PA.

- Business cardholder logins are sent to each cardholder from their designated PA. The Bank does not create these credentials or determine the access level given.

What notification does the business PA receive after they are setup?

- PAs will receive a system-generated email from alerts@spendtrack.fiserv.com. After they receive this email, they will be able to establish their user credentials.

Does the system generated email have an expiration?

- Yes, the email will expire after 48 hours. If past 48 hours, you must contact First Bank & Trust or for business cardholders, the business PA, to resend the invitation.

What is my username and password for SpendTrack?

- You will establish your credentials after you receive the system generated email from alerts@spendtrack.fiserv.com.

Can my business account have multiple PAs?

- Multiple PAs are allowed. Each PA must have a unique email address.

I have multiple business accounts; can I have one PA login?

- Yes, it is possible to be a PA for more than one company using the same email address.

Will I be able to access my card through the single sign on (SSO)?

- Yes, if you are a user who has been authorized to receive Digital Banking or Cash Management access, you will be able to view credit card accounts through the SSO. However, you will be viewing account information as a cardholder and not as a PA.

I’m not able to access my business credit card account through the SSO, why?

- You may not be authorized to receive access to Digital Banking or Cash Management. Please work with your account PA or your business account officer.

How do my business credit card account holders receive access to their individual credit card account?

- PAs are responsible for providing access to each individual cardholder.

- An email with a link to access the card is sent to each User.

- If you wish for your cardholders to have access to their individual account, we recommend that the PA provide that access as soon as the new card has been received by the cardholder.

- Cardholders are not able to create their own user credentials for account access.

How can individual cardholders of my business account access their accounts?

- Individual cardholders will access the manual link that is sent in the emailed invitation. They should save this link for future use.

Once I’ve established my new credentials, where can I access my credit card(s) in Digital Banking?

- Digital Banking users will be able to access their account under the Accounts section under the business login credentials only.

- In the account options, click Credit Card Account for access.

- Cash Management users will be able to access their accounts on the Credit Card tab.

- Cash Management users must have access to the credit cards as a PA for the SSO to work properly.

- PAs will need to click on the Control Account number to access their PA level credentials.

- Individual cardholders who do not utilize Digital Banking or Cash Management will access the manual link that was sent to them by the company PA.

Once I’ve established my PA or User credentials, where can I access my account if I don’t use Digital Banking or Cash Management?

Can I enroll in transaction alerts?

- Alerts from SpendTrack are not available at this time, but you can take advantage of alerts that are available from Visa. Go to visapurchasealerts.com and create an account.

What file types are available for exporting transaction data?

- QuickBooks Direct

- QBO and CSV

Can I connect directly to QuickBooks?

- Web Connect is supported for QuickBooks Online

- You will need to establish connection to your accounting software. Once logged in, select “view all transactions” and select Connect to QuickBooks. Then follow the prompts.

- Clients using the QuickBooks Desktop need to use manual downloads into either CSV or QBO format and then use their desktop version to manually import the CSV or QBO downloaded file.

I cannot get QuickBooks Online to connect using the “Connect to QuickBooks” option.

- Intermittent network errors can sometimes cause this issue. Trying again at a later time may provide resolution.

- In the event that research is needed for your particular account, a temporary workaround is available. Program Administrators and users can save the SpendTrack transaction files in CSV or QBO format, then import the file manually in QuickBooks.

I cannot get QuickBooks Desktop to connect using the “Connect to QuickBooks” option.

- This direct connect option is unavailable for QuickBooks Desktop.

- Clients using the QuickBooks Desktop need to use manual downloads into either CSV or QBO format and then use their desktop version to manually import the CSV or QBO downloaded file.

Can I connect directly from QuickBooks to SpendTrack?

- Direct connect from QuickBooks to SpendTrack is not available by linking your SpendTrack credentials into your QuickBooks Online account. The direct connection only works from SpendTrack to QuickBooks at this time.

- This is being evaluated by the vendor.

Can I download a Quicken compatible file?

- As Quicken is primarily a personal finance and budgeting software, QIF file formats are not currently available through the SpendTrack Business solution.

- This is being evaluated by the vendor.

How do I export transactions if I am a PA with access to more than one credit card company in SpendTrack?

Company A

- User logs in to SpendTrack and clicks on View Transactions link of the control account to connect to QuickBooks

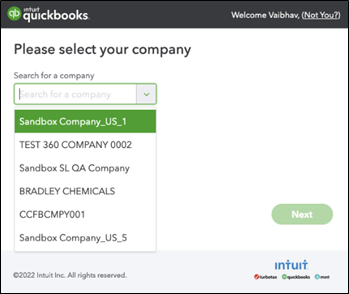

- User is presented an option to Login to QuickBooks, and after successful login will have an option to choose the company from the drop down in QuickBooks. [See Select-Company screenshot]

- User needs to select the company A in QuickBooks and click on export transactions from SpendTrack

Company B

- User switches to Company B in SpendTrack from User Preferences > Switch Company and then needs to click on disconnect button. [See Disconnect screenshot]

- User logs back into QuickBooks after clicking on Connect to QuickBooks in SpendTrack.

- User selects Company B in QuickBooks and clicks on to export the transactions from SpendTrack. [See Select-Company screenshot]

- Repeat for all Companies, if necessary.

Select-Company Screenshot

Disconnect Screenshot

Are automated and daily downloads available for QuickBooks?

- This functionality is not currently available. It is being evaluated by the vendor.

How often can I download transactions from SpendTrack to QuickBooks?

- After each statement cycle you can download transactions to QuickBooks.

Who can I call if I have questions?

- You may call 800.259.0112 for 24/7 Customer Service.

- Call us at 800.843.1552 during business hours:

- Mon-Fri: 7:30 AM – 6 PM CST

- Saturdays: 8 AM – Noon CST

- You may also stop into any of our locations.

How am I alerted for suspected fraud?

- When suspected fraud occurs, cardholders will receive an email, text message and/or voice call (in that order). Cardholder’s contact information must be up to date to receive any of these alerts.

- Emails are generated 24/7. Cardholders should respond to these messages, confirming or declining fraud activity.

- Texts are sent and calls are dialed from 8 AM – 9PM CST, every day of the week. Cardholders should respond to these messages, confirming or declining fraud activity.

- To ensure you are receiving alerts be sure your contact information is up to date

How do I update my contact information?

- Log in to your credit card account and edit your profile

- For 24/7 Customer Service call 800.259.0112.

- Call us at 800.843.1552 during business hours:

- Mon-Fri: 7:30 AM – 6 PM CST

- Saturdays: 8 AM – Noon CST